direct vs indirect cash flow gaap

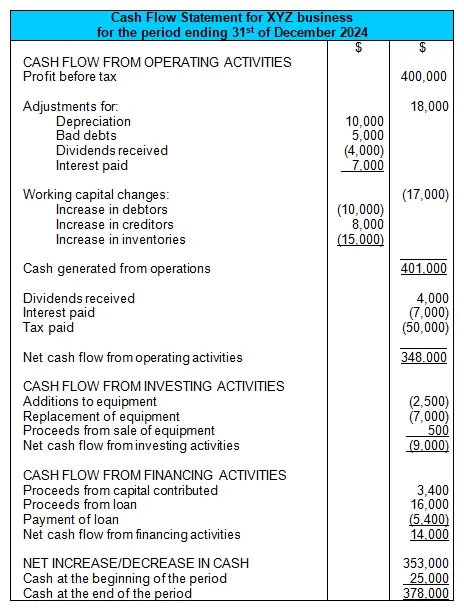

With the indirect cash flow you are reconciling back to cash. The difference however only applies to the operating cash flow.

Produce Gaap Compliant Statement Of Cash Flows Reports In Xero Hq Xero Blog

106 Both encourage the use of the direct method.

. Exceptions exist under US GAAP. If you are a QuickBooks user QuickBooks generates their cash flow reports using the indirect method. In contrast the indirect method starts with net income for-profit entities or the change in net assets NFP entities adds back non-cash expenses removes gains and losses and adjusts for the changes in current asset and current liability accounts.

Notably the most commonly used cash flow method is indirect cash flow. Indirect method of cash flow. Comparing the Direct and Indirect Cash Flow Methods.

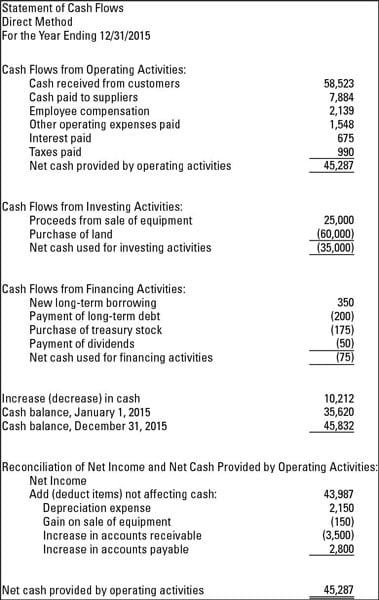

An example of the tax treatment is provided below. The key difference between direct and indirect cash flow method is that direct cash flow method lists all the major operating cash receipts and payments for the accounting year by source whereas indirect cash flow method adjusts net income for the changes in balance sheet accounts to calculate the cash flow from operating activities. 108 In addition unlike IFRSs US.

The direct method and the indirect method are alternative ways to present information in an organizations statement of cash flows. Both methods of cash flow analysis yield the same total cash flow amount but the way the information is presented is different. Assume that a company sold land for 100000 and paid.

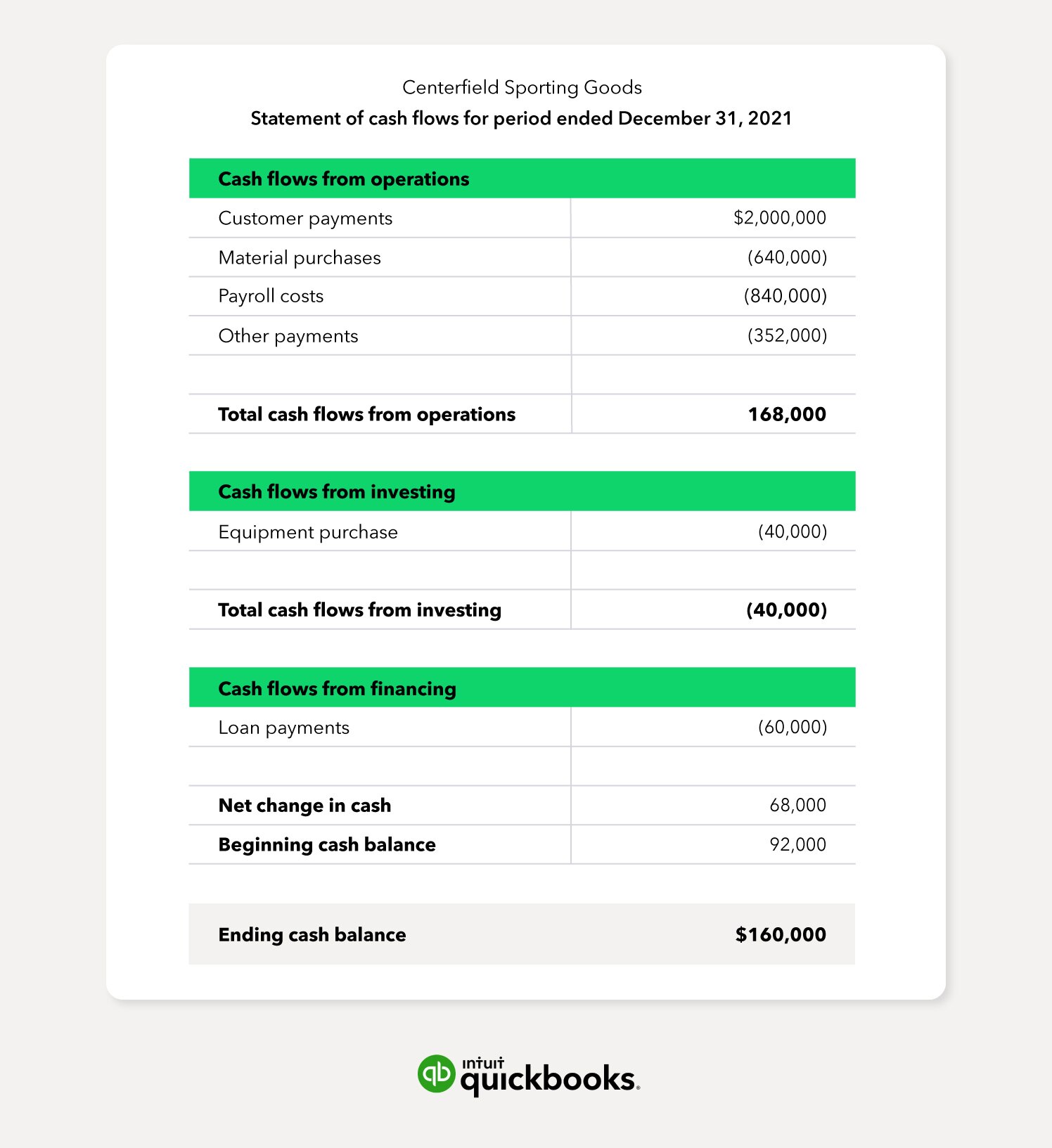

The direct method of cash-flow calculation is more straightforward and it shows all your major gross cash receipts and gross cash payments. The direct method provides information which may be useful in estimating future cash flows and which is not available under the indirect method US GAAP allows businesses to choose the direct or indirect method but even when using the direct method a reconciliation of cash flow from operating activities to net profit net income is required. The direct method details where cash comes from and where it goes.

Income tax reported as operating activity except when tax is an expense related to investing or financing activity. Under US GAAP defined benefit pension plans that present financial information under ASC 960 3. Ad Our Business Experts Provide An In-Depth Analysis To Uncover Business Opportunity.

The following are the common types of adjustments that are made to. The cash flow statement is divided into three categoriescash flows from operating activities cash flows. The indirect method backs into cash flow by adjusting net profit or net income with changes applied from your non-cash transactions.

In contrast under the indirect method cash flow from operating activities is calculated by first taking the net income from a companys income statement. Although the presentation of operating. GAAP requires a reconciliation of net cash flow from.

Statement of cash flows Subject. Under the direct method you present the cash flow from operating activities as actual cash outflows and inflows on a cash basis without beginning from net income on an accrued basis. Currently more than 120 countries require or permit the use of International Financial Reporting Standards IFRS with a significant number of countries requiring IFRS or some form of IFRS by public entities as defined by those specific countries.

Interest received must be classified as an operating activity. The main difference between the direct method and the indirect method of preparing cash flow statements involves the cash flows from operating expenses. As discussed in ASC 230-10-45-28 cash flows related to operating activities may be presented in one of two ways the direct method or the indirect method.

You may also see the indirect cash flow method referred to as the reconciliation method. Cash flows from investing activities and cash flows from financing activities are the same for a company regardless of whether the direct method or indirect method is used. The actual inflows received and the outflows paid for and not accrued are added and subtracted from the cash flow.

The direct method requires the use of the actual cash inflows and outflows of the organization ie the actual cash inflows and outflows that took place within the company when the incomes and payments are actually received and not when they are accrued. US GAAP also requires similar adjustments. The presentation of investing and financing activities are identical under the direct and indirect methods.

For example if a retailer sells an item on credit the indirect method will consider this as income and reflect this in the figures whereas the direct method wont include it until the bill has been paid. Revenue cash inflows and expense cash outflows are adjusted by multiplying the cash flow by. The difference between these methods lies in the presentation of information within the cash flows from operating activities section of the statement.

The direct method lists the cash receipts and cash payments made during the accounting period. Under this method net cash provided or used by operating activities is determined by adding back or deducting from net income those items that do not effect on cash. Under IFRS Standards there are no scope exceptions and all companies must present a statement of cash flows in a complete set of financial statements.

With respect to the treatment of activities in cash flow statements there are some differences in IFRS and US GAAP. The indirect method begins with your net income. Also if a company.

The indirect method on the other hand focuses on net income and may include cash that is not yet in the business. Statement of cash flows Keywords. Indirect method is the most widely used method for the calculation of net cash flow from operating activities.

Indirect Method vs. 95 permit the direct and the indirect method of reporting cash flows from operating activities. Bank overdrafts are classified as part of cash and cash equivalents Either the direct or indirect method may be used for reporting cash flow from operating activities.

GAAP also calls the indirect method the reconciliation method. Alternatively the direct method begins with the cash amounts received and paid out by your business. There are no presentation.

However if a company used the direct method it is also required to show reconciliation between net income and cash flow from operations. Up to 5 cash back IAS 7 and Section 230-10-45 FASB Statement No. However the direct method can be tedious and time-consuming which is why business owners tend to.

However of the two the direct method is generally encouraged. While both are ways of calculating your net cash flow from operating activities the main distinction is the starting point and types of calculations each uses. Indirect Cash Flow Method.

Our Business Consultants Will Partner With You To Build Financial and Operational Success. 642 Direct versus indirect method. Statement of cash flows always required under IFRS Standards.

Cash Flow Statement Finance Train

Direct Vs Indirect The Best Cash Flow Method Vena

Prepare The Statement Of Cash Flows Using The Indirect Method Principles Of Accounting Volume 1 Financial Accounting

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

What Is The Difference Between The Direct And Indirect Cash Flow Statement Methods Universal Cpa Review

/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

Cash Flow From Investing Activities Definition

Statement Of Cash Flows Direct Method Format Example Preparation

Direct Vs Indirect Method Statement Of Cash Flows Youtube

The Indirect Cash Flow Statement Method

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Statement Of Cash Flows Indirect Method Format Example Preparation

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Everything You Need To Know About A Cash Flow Statement 2022

Statement Of Cash Flows What It Is How To Read It Quickbooks

Methods For Preparing The Statement Of Cash Flows Dummies

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal